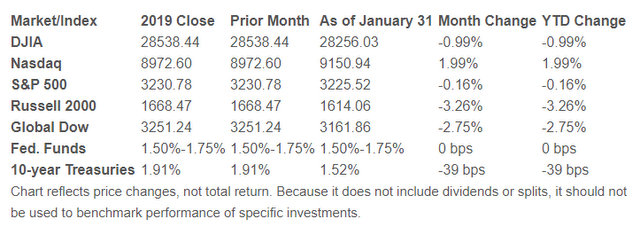

Murphys, CA…January was full of ups and downs as investors rode a wave of uncertainty. The month began with many of the benchmark indexes listed here losing value (except for the Nasdaq) only to surge ahead during the middle of the month. However, fears that a widespread outbreak of the coronavirus would impact global economic growth pushed investors away from stocks, which lost significant value by the end of the month.

By the close of trading on the last day of January, only the tech-heavy Nasdaq gained value, as each of the remaining benchmark indexes listed here fell, led by the small caps of the Russell 2000, which plummeted by more than 3.25%. The Global Dow dropped 2.75%, followed by the Dow and the S&P 500. Unfortunately, the momentum enjoyed in December didn’t carry over to January for stock investors.

By the close of trading on January 31, the price of crude oil (WTI) was $51.61 per barrel, well below the December 31 price of $61.21 per barrel. The national average retail regular gasoline price was $2.506 per gallon on January 27, down from the December 30 selling price of $2.571 but $0.250 more than a year ago. The price of gold rose by the end of January, climbing to $1,592.70 by close of business on the 31st, up from its $1,520.00 price at the end of December.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Latest Economic Reports

- Employment: December saw 145,000 new jobs added, with notable job gains occurring in retail trade and health care. In 2019, employment rose by 2.1 million, down from a gain of 2.7 million in 2018. The unemployment rate remained at 3.5% for the month and the number of unemployed persons stood at 5.8 million. A year earlier, the unemployment rate was 3.9% with 6.3 million unemployed. In December, average hourly earnings for all employees rose by $0.03 to $28.32. Average hourly earnings increased by 2.9% in 2019. The average workweek was unchanged at 34.3 hours in December. The labor participation rate for December remained at 63.2% (63.0% last December), while the employment-population ratio closed 2019 at 61.0% for the fourth consecutive month (60.6% in December 2018).

- FOMC/interest rates: Following its latest meeting in January, the Federal Open Market Committee decided to maintain the target range for the federal funds rate at 1.50%-1.75%. The rate hasn’t changed since it was decreased last October. While the Committee noted positive economic growth, increased consumer spending, and a strong labor market, fixed business investment and exports remain weak, and inflation continues to run below the Fed’s 2.0% target. The Committee meets again in March.

- GDP/budget: According to the advance estimate for the fourth-quarter gross domestic product, the economy accelerated at an annualized rate of 2.1%. This is the same rate of growth as in the third quarter. Consumer spending grew at a rate of 1.8% (3.2% in the third quarter), fixed investment inched up 0.1% in the fourth quarter (-0.8% in the third quarter), and although nonresidential fixed investment fell 1.5% in the fourth quarter, it was an improvement over the 2.3% drop in the prior quarter. Consumer prices advanced at a rate of 1.6% in the fourth quarter, comparable to the third quarter (1.5%). Disposable personal income increased 3.1% in the fourth quarter, compared with an increase of 4.5% in the third quarter. December, the third month of the government’s fiscal year, saw the federal budget deficit hit $13.3 billion ($13.5 billion in December 2019). Through the first quarter of the 2020 fiscal year, the deficit sits at $356.6 billion, 11.8% greater than the deficit over the same period last fiscal year. Government spending over the first three months of the fiscal year outpaced receipts 6.7% to 4.6%. Comparing the first quarter of FY 2020 to the first three months of FY 2019, defense spending is up 9.2%, Medicare expenditures increased 8.0%, and Social Security payments rose 5.8%. Receipts over the same period saw individual income taxes climb 3.2%, employment and general retirement receipts rise 5.9%, and corporate taxes jumped 23.2%, while receipts from customs duties, impacted by the tariffs on Chinese goods, vaulted 18.6%.

- Inflation/consumer spending: According to the Personal Income and Outlays report, inflationary pressures remain weak, as prices for consumer goods and services rose 0.3% in December after inching up 0.1% in November. Prices are up 1.6% over the last 12 months. Consumer prices excluding food and energy rose 0.2% in December (0.1% in November) and are up 1.6% year-over-year. Personal income and disposable (after-tax) personal income each advanced 0.2% in December. Consumers continued to spend, as personal consumption expenditures increased 0.3% in December after expanding 0.4% the previous month.

- The Consumer Price Index inched ahead 0.2% in December following a 0.3% increase in November. For 2019, the CPI has risen 2.3%. Increases in shelter and energy were major factors in the CPI increase. Energy prices increased 1.4% in December (3.4% for the year), and medical care commodities increased 1.5% for December and 2.5% for 2019. The CPI less food and energy inched up 0.1% for the month and 2.3% for 2019.

- Prices producers receive for goods and services edged up 0.1% in December (no change in November, revised). The index increased 1.3% in 2019 after a 2.6% advance in 2018. Producer prices less foods, energy, and trade services rose 0.1% in December following no change in November. For 2019, prices less foods, energy, and trade services moved up 1.5% after advancing 2.8% in 2018. A 1.5% increase in energy prices pushed goods prices up 0.3% in December, and gasoline prices jumped 3.7%.

- Housing: The housing sector has been anything but consistent this year. After falling 1.7% in November, existing home sales rose 3.6% in December and are up 10.8% over last December. Year-over-year, sales of existing homes were at the same pace as in 2018. The median sales price for existing homes was $274,500 in December, compared to $271,300 in November. Existing home prices were up 7.8% from December 2018. Total housing inventory at the end of December sat at 1.40 million units (representing a 3.0-month supply), down from November’s 3.7-month supply. Sales of new single-family homes fell in December, down 0.4% from November’s totals. However, sales are 23.0% above the December 2018 estimate. There were about 10.3% more homes sold in 2019 compared to the previous year. The median sales price of new houses sold in December was $331,400 ($330,800 in November). The average sales price was $384,500 ($388,200 in November). Available inventory, at a 5.7-month supply, was slightly higher than November’s 5.4-month supply.

- Manufacturing: After rebounding in November, industrial production declined 0.3% in December, driven by a 5.6% decrease in utilities. The drop for utilities resulted from a large decrease in demand for heating, as unseasonably warm weather in December followed an unseasonably cold November. Manufacturing output advanced 0.2% in December, despite a 4.6% decrease in manufacturing of motor vehicles and parts. Utilities increased 1.3% in December. Total industrial production was 1.0% lower in December than it was a year earlier. Following a November decrease, new orders for durable goods rose 2.4% in December. However, excluding transportation, new orders fell 0.1%. Transportation equipment, up following three consecutive monthly decreases, drove the increase, climbing $5.9 billion, or 7.6%. New orders for capital goods (used by businesses to produce consumer goods) dropped 6.5% in December following a 7.8% tumble in November.

- Imports and exports: Import prices rose 0.3% in December after ticking up 0.1% the prior month. The gain in import prices was the largest monthly advance since the index increased 0.6% in March. Prices for imports rose 0.5% in 2019, after decreasing 0.9% in 2018. The 12-month advance in December for import prices was the largest over-the-year increase since the index rose 0.7% between November 2017 and November 2018. Export prices fell 0.2% in December following a 0.2% increase in November. Prices for exports declined 0.7% in 2019 following a 1.1% increase in 2018. The 2019 drop was the first calendar-year fall in export prices since the index declined 6.6% in 2015. The international trade in goods deficit was $68.3 billion in December, up $5.3 billion from $63.0 billion in November. Exports of goods for December rose 0.3% to $137.0 billion, $0.4 billion more than November exports. Imports of goods for December climbed 2.9% to $205.3 billion, $5.8 billion more than November imports. The latest information on international trade in goods and services, out January 7, is for November and shows that the goods and services deficit was $43.1 billion, down $3.9 billion from the $46.9 billion deficit in October. The narrowing deficit resulted from a 0.7% rise in exports to $208.6 billion and a 1.0% drop in imports to $251.7 billion. October exports were $0.4 billion less than September exports. October imports were $4.3 billion under September imports. Year-to-date, the goods and services deficit decreased $3.9 billion, or 0.7%, from the same period in 2018.

- International markets: Four major international banks refrained from lowering interest rates in a move aimed at bolstering their respective economies. The Bank of England, the European Central Bank, the Bank of Japan, and the Bank of Canada each maintained their respective monetary policies last month. At the World Economic Forum in Davos, Switzerland, the United States gave notice that it was ready to address trade relations with the European Union. President Trump threatened to impose significant tariffs on European cars if a more favorable trade agreement between the United States and European Union could not be reached. Ongoing trade uncertainties have impacted Japan, which has seen its exports decline for thirteen consecutive months.

- Consumer confidence: The Conference Board Consumer Confidence Index® increased in January following a moderate increase in December. The Present Situation Index — based on consumers’ assessment of current business and labor market conditions — increased last month, as did the Expectations Index, which is based on consumers’ short-term outlook for income, business, and labor market conditions.

Eye on the Month Ahead

Aside from the impeachment trial, investors will be watching the employment figures for January and news from the industrial sector. Job growth slowed a bit toward the end of 2019, although numbers remained relatively strong. Manufacturing and industrial production were generally weak for most of last year, impacted by the trade war between the United States and China. It will be interesting to see if the first phase of an agreement between the world’s largest economies is enough to help the manufacturing sector.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e. wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indices listed are unmanaged and are not available for direct investment.Prepared by Broadridge Advisor Solutions Copyright 2020.

IMPORTANT DISCLOSURES

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.