Washington, DC…Most of the nation’s small businesses do not require employees to get COVID-19 vaccines or tests to return to work, according to the first results of Phase 4 of the U.S. Census Bureau’s Small Business Pulse Survey (SBPS) released last week. SBPS was launched Feb. 15, to measure the effect of changing business conditions during the coronavirus pandemic on our nation’s small businesses. Many prior survey questions have evolved and additional questions such as those related to coronavirus vaccinations and tests have been added.

The recent data make it increasingly clear that SBPS is sufficiently resilient and current to measure the economic impact of the coronavirus pandemic as well as other natural disasters such as the recent storms that hit the southern United States.

The value of this experimental data product is far-reaching, providing decisionmakers and the public with near real-time insight into the impact of events, from the pandemic to natural disasters, on the small-business economy.

Following are the survey’s new questions about the vaccine and initial data results:

Question: In the last week, did this business require employees to test negative for COVID-19 before physically coming to work? Respondents may select only one of the following check boxes: “yes,” “no” or “not applicable, this business did not have employees physically coming to work in the last week.”

Responses: 10.0% said yes; 70.1% said no; and 19.9% said not applicable or n/a. Responses in two specific sectors outpaced the national average: 15.5% of health care and 14.3% of accommodation/food service businesses for requiring a negative test.

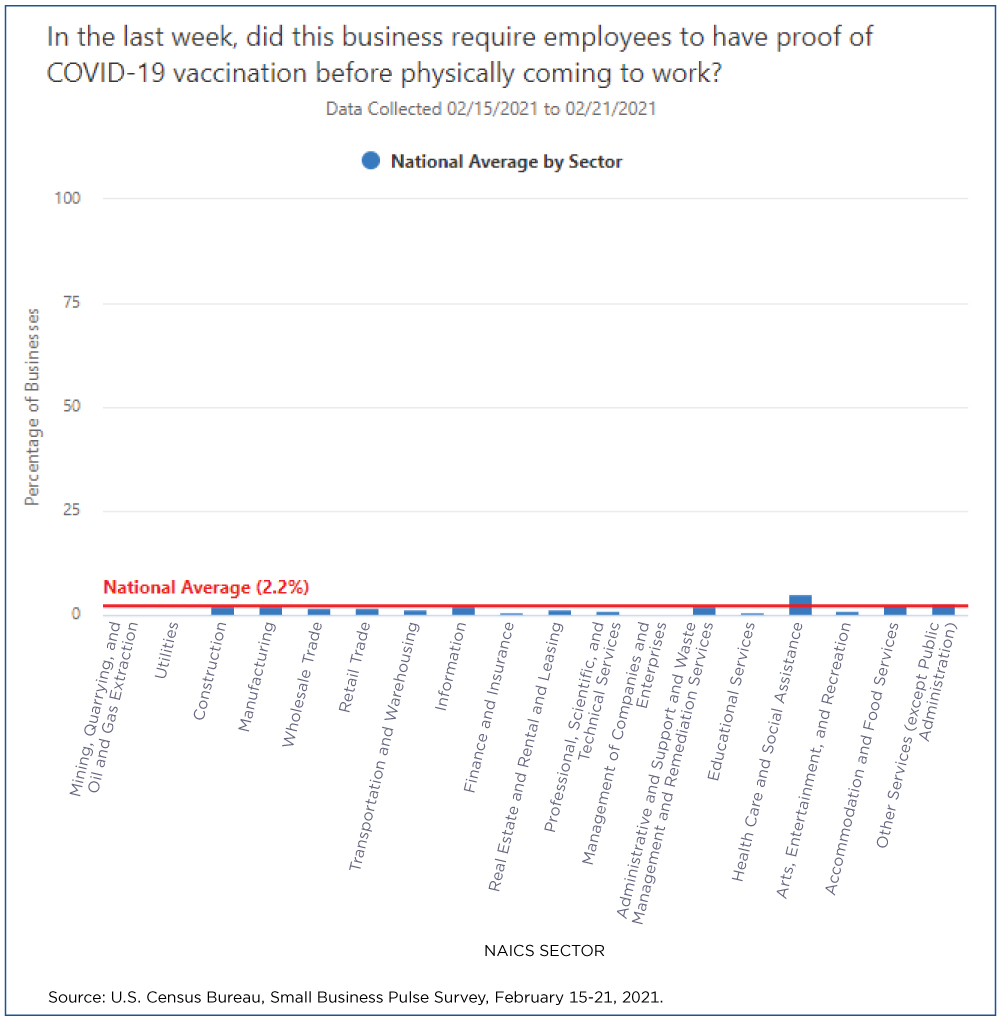

Question: In the last week, did this business require employees to have proof of COVID-19 vaccination before physically coming to work? Respondents may select only one: “yes,” “no” or “not applicable, this business did not have employees physically coming to work in the last week.”

Responses: 2.2% said yes; 78.4% said no; and 19.4% said not applicable. Health care was by far the largest sector requiring a vaccine with 62% of its respondents checking that box.

SBPS complements existing Census Bureau data collections by providing high-frequency, detailed information on the challenges that small businesses (those with 1-499 employees) are facing during the pandemic.

The survey also includes information on small business operations, requests and receipt of assistance, capital expenditures and expectations for recovery. SBPS has been conducted in 9-week phases: Phase 1 started in late April 2020; Phase 2 began in August; and Phase 3 started in November.

In the first week of Phase 4, the survey was sent to approximately 100,000 businesses and about 25,000 responded.

Data are available by sector, state and for the 50 most populous Metropolitan Statistical Areas (MSAs) in addition to Puerto Rico, as well as sub-sector, state by sector and by employee size class.

Survey results provide local, state and federal officials essential up-to-date data to help them make informed policy decisions. The information also aids businesses in making economic decisions and assists researchers studying the economic effects of the pandemic.

Other content changes in Phase 4 include the addition of new questions on leased space, planned capital expenditures and business travel:

Question: The White House declared a national emergency because of the coronavirus pandemic on March 13, 2020. Since March 13, 2020, did this business change the amount of square footage leased/rented for operations? Respondents may select only one of the following responses: “yes, increased,” “yes, decreased,” “no change” or “not applicable, this business does not lease/rent space.”

Responses: 2.6% said yes, increased; 6.1% said yes, decreased; 76.3% said no change; and 15.1% said not applicable. The decrease in leased space outpaced the increase, but both are dwarfed by no change.

Question: Since March 13, 2020, what changes did this business make to its planned capital expenditures for 2020? Respondents may select all of the following answers that apply: “canceled planned capital expenditures,” “postponed planned capital expenditures,” “decreased planned capital expenditures,” “increased planned capital expenditures,” “introduced new unplanned capital expenditures,” “this business had no changes to planned capital expenditures for 2020” and “this business had no planned capital expenditures for 2020.”

Responses: 12.8% canceled planned capital expenditures; 22% postponed planned capital expenditures; 15.6% decreased planned capital expenditures; 2.9% increased planned capital expenditures; 7.5% introduced new unplanned capital expenditures; 21.3% said this business had no changes to planned capital expenditures for 2020 and 33% said this business had no planned capital expenditures for 2020.

Question: In the next 6 months, do you think this business will have business travel expenditures for air, rail, car rental, or lodging? Respondents may select only one of the following: “yes,” “no” and “not applicable, this business does not usually have business travel expenditures.”

Responses: 26.5% said yes, 42.7% said no and 30.8% said not applicable. Far fewer small businesses anticipated travel expenses in the next six months.

Phase 4 excluded earlier questions about rehiring employees, working from home, cash flow, loan defaults, other payment defaults and online platforms. (Question on product service offerings and mode of product delivery have not been included since Phase 1.) Phase 4 also includes updates to answer options for questions on financial assistance, factors that affect capacity and future needs.

All SBPS data are available for downloads.

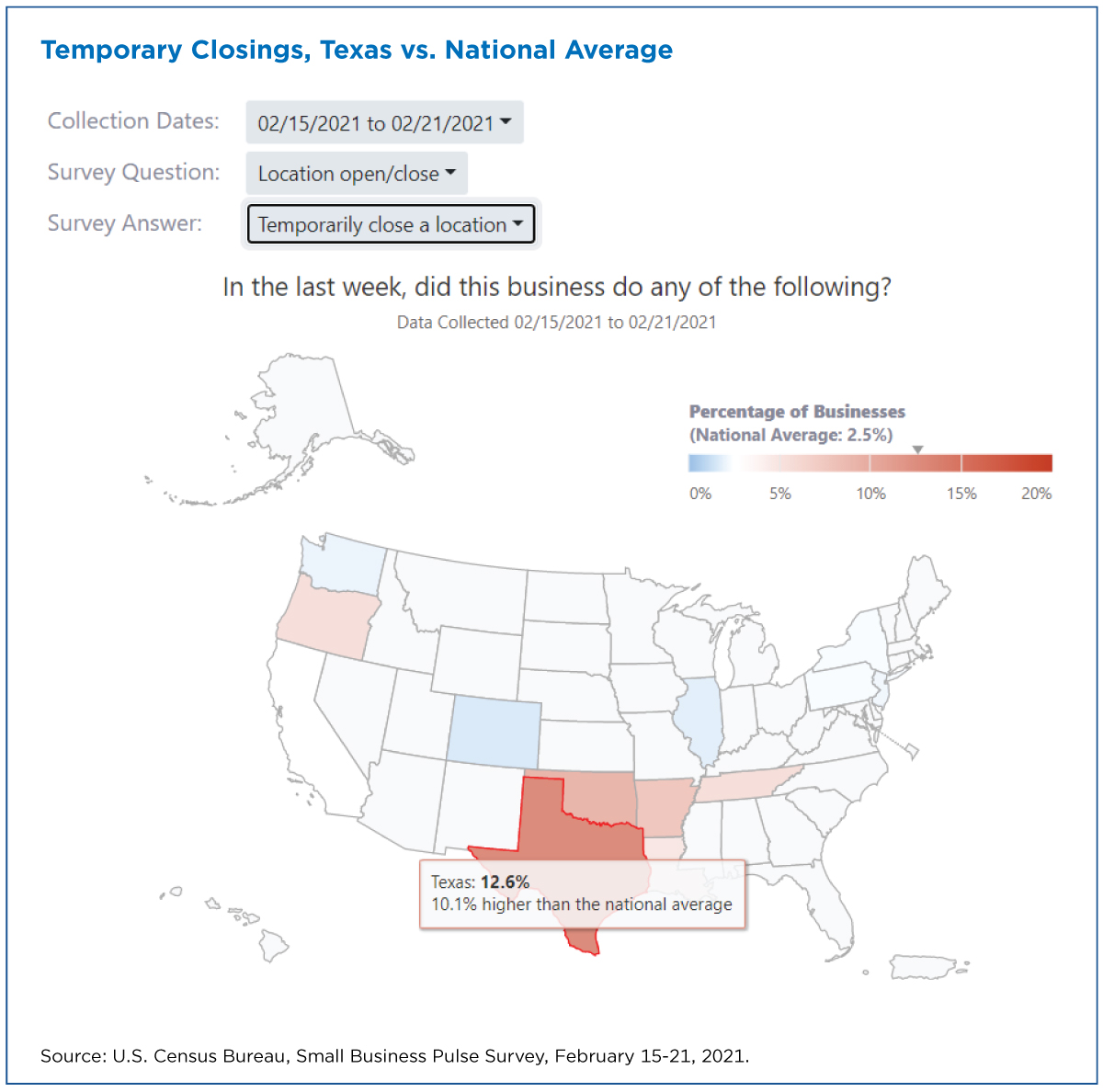

How Texas Small Businesses Are Affected by Storms

The first wave of data from Phase 4 of the Small Business Pulse Survey arrived on Feb. 25, painting a clear picture of the significant impact recent winter storms had on Texas.

It’s notable that while designed to measure changing business conditions during the coronavirus pandemic, the SBPS also captures the impact of natural disasters on small business.