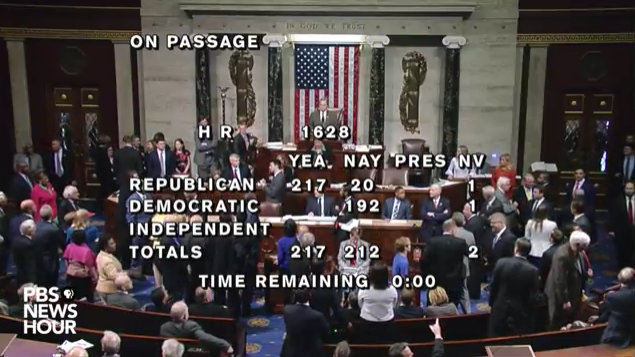

Washington, DC…The House Republicans narrowly advanced the “American Healthcare Act” on to the Senate. Many of the Obamacare mandates have been stripped in this bill including individual and employer mandates. The full text of the bill in its’ current form is below.

Union Calendar No. 30

115th CONGRESS

1st Session

H. R. 1628

[Report No. 115-52]

To provide for reconciliation pursuant to title II of the concurrent

resolution on the budget for fiscal year 2017.

_______________________________________________________________________

IN THE HOUSE OF REPRESENTATIVES

March 20, 2017

Mrs. Black from the Committee on the Budget, reported the following

bill; which was committed to the Committee of the Whole House on the

State of the Union and ordered to be printed

_______________________________________________________________________

A BILL

To provide for reconciliation pursuant to title II of the concurrent

resolution on the budget for fiscal year 2017.

Be it enacted by the Senate and House of Representatives of the

United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the “American Health Care Act of 2017”.

SEC. 2. TABLE OF CONTENTS.

The table of contents of this Act is as follows:

Sec. 1. Short title.

Sec. 2. Table of contents.

TITLE I–ENERGY AND COMMERCE

Subtitle A–Patient Access to Public Health Programs

Sec. 101. The Prevention and Public Health Fund.

Sec. 102. Community health center program.

Sec. 103. Federal payments to States.

Subtitle B–Medicaid Program Enhancement

Sec. 111. Repeal of Medicaid provisions.

Sec. 112. Repeal of Medicaid expansion.

Sec. 113. Elimination of DSH cuts.

Sec. 114. Reducing State Medicaid costs.

Sec. 115. Safety net funding for non-expansion States.

Sec. 116. Providing incentives for increased frequency of eligibility

redeterminations.

Subtitle C–Per Capita Allotment for Medical Assistance

Sec. 121. Per capita allotment for medical assistance.

Subtitle D–Patient Relief and Health Insurance Market Stability

Sec. 131. Repeal of cost-sharing subsidy.

Sec. 132. Patient and State Stability Fund.

Sec. 133. Continuous health insurance coverage incentive.

Sec. 134. Increasing coverage options.

Sec. 135. Change in permissible age variation in health insurance

premium rates.

TITLE II–COMMITTEE ON WAYS AND MEANS

Subtitle A–Repeal and Replace of Health-Related Tax Policy

Sec. 201. Recapture excess advance payments of premium tax credits.

Sec. 202. Additional modifications to premium tax credit.

Sec. 203. Premium tax credit.

Sec. 204. Small business tax credit.

Sec. 205. Individual mandate.

Sec. 206. Employer mandate.

Sec. 207. Repeal of the tax on employee health insurance premiums and

health plan benefits.

Sec. 208. Repeal of tax on over-the-counter medications.

Sec. 209. Repeal of increase of tax on health savings accounts.

Sec. 210. Repeal of limitations on contributions to flexible spending

accounts.

Sec. 211. Repeal of medical device excise tax.

Sec. 212. Repeal of elimination of deduction for expenses allocable to

medicare part D subsidy.

Sec. 213. Repeal of increase in income threshold for determining

medical care deduction.

Sec. 214. Repeal of Medicare tax increase.

Sec. 215. Refundable tax credit for health insurance coverage.

Sec. 216. Maximum contribution limit to health savings account

increased to amount of deductible and out-

of-pocket limitation.

Sec. 217. Allow both spouses to make catch-up contributions to the same

health savings account.

Sec. 218. Special rule for certain medical expenses incurred before

establishment of health savings account.

Subtitle B–Repeal of Certain Consumer Taxes

Sec. 221. Repeal of tax on prescription medications.

Sec. 222. Repeal of health insurance tax.

Subtitle C–Repeal of Tanning Tax

Sec. 231. Repeal of tanning tax.

Subtitle D–Remuneration From Certain Insurers

Sec. 241. Remuneration from certain insurers.

Subtitle E–Repeal of Net Investment Income Tax

Sec. 251. Repeal of net investment income tax.

TITLE I–ENERGY AND COMMERCE

Subtitle A–Patient Access to Public Health Programs

SEC. 101. THE PREVENTION AND PUBLIC HEALTH FUND.

(a) In General.–Subsection (b) of section 4002 of the Patient

Protection and Affordable Care Act (42 U.S.C. 300u-11), as amended by

section 5009 of the 21st Century Cures Act, is amended–

(1) in paragraph (2), by adding “and” at the end;

(2) in paragraph (3)–

(A) by striking “each of fiscal years 2018 and

2019” and inserting “fiscal year 2018”; and

(B) by striking the semicolon at the end and

inserting a period; and

(3) by striking paragraphs (4) through (8).

(b) Rescission of Unobligated Funds.–Of the funds made available

by such section 4002, the unobligated balance at the end of fiscal year

2018 is rescinded.

SEC. 102. COMMUNITY HEALTH CENTER PROGRAM.

Effective as if included in the enactment of the Medicare Access

and CHIP Reauthorization Act of 2015 (Public Law 114-10, 129 Stat. 87),

paragraph (1) of section 221(a) of such Act is amended by inserting “,

and an additional $422,000,000 for fiscal year 2017” after “2017”.

SEC. 103. FEDERAL PAYMENTS TO STATES.

(a) In General.–Notwithstanding section 504(a), 1902(a)(23),

1903(a), 2002, 2005(a)(4), 2102(a)(7), or 2105(a)(1) of the Social

Security Act (42 U.S.C. 704(a), 1396a(a)(23), 1396b(a), 1397a,

1397d(a)(4), 1397bb(a)(7), 1397ee(a)(1)), or the terms of any Medicaid

waiver in effect on the date of enactment of this Act that is approved

under section 1115 or 1915 of the Social Security Act (42 U.S.C. 1315,

1396n), for the 1-year period beginning on the date of the enactment of

this Act, no Federal funds provided from a program referred to in this

subsection that is considered direct spending for any year may be made

available to a State for payments to a prohibited entity, whether made

directly to the prohibited entity or through a managed care

organization under contract with the State.

(b) Definitions.–In this section:

(1) Prohibited entity.–The term “prohibited entity”

means an entity, including its affiliates, subsidiaries,

successors, and clinics–

(A) that, as of the date of enactment of this Act–

(i) is an organization described in section

501(c)(3) of the Internal Revenue Code of 1986

and exempt from tax under section 501(a) of

such Code;

(ii) is an essential community provider

described in section 156.235 of title 45, Code

of Federal Regulations (as in effect on the

date of enactment of this Act), that is

primarily engaged in family planning services,

reproductive health, and related medical care;

and

(iii) provides for abortions, other than an

abortion–

(I) if the pregnancy is the result

of an act of rape or incest; or

(II) in the case where a woman

suffers from a physical disorder,

physical injury, or physical illness

that would, as certified by a

physician, place the woman in danger of

death unless an abortion is performed,

including a life-endangering physical

condition caused by or arising from the

pregnancy itself; and

(B) for which the total amount of Federal and State

expenditures under the Medicaid program under title XIX

of the Social Security Act in fiscal year 2014 made

directly to the entity and to any affiliates,

subsidiaries, successors, or clinics of the entity, or

made to the entity and to any affiliates, subsidiaries,

successors, or clinics of the entity as part of a

nationwide health care provider network, exceeded

$350,000,000.

(2) Direct spending.–The term “direct spending” has the

meaning given that term under section 250(c) of the Balanced

Budget and Emergency Deficit Control Act of 1985 (2 U.S.C.

900(c)).

Subtitle B–Medicaid Program Enhancement

SEC. 111. REPEAL OF MEDICAID PROVISIONS.

The Social Security Act is amended–

(1) in section 1902 (42 U.S.C. 1396a)–

(A) in subsection (a)(47)(B), by inserting “and

provided that any such election shall cease to be

effective on January 1, 2020, and no such election

shall be made after that date” before the semicolon at

the end; and

(B) in subsection (l)(2)(C), by inserting “and

ending December 31, 2019,” after “January 1, 2014,”;

(2) in section 1915(k)(2) (42 U.S.C. 1396n(k)(2)), by

striking “during the period described in paragraph (1)” and

inserting “on or after the date referred to in paragraph (1)

and before January 1, 2020”; and

(3) in section 1920(e) (42 U.S.C. 1396r-1(e)), by striking

“under clause (i)(VIII), clause (i)(IX), or clause (ii)(XX) of

subsection (a)(10)(A)” and inserting “under clause (i)(VIII)

or clause (ii)(XX) of section 1902(a)(10)(A) before January 1,

2020, section 1902(a)(10)(A)(i)(IX),”.

SEC. 112. REPEAL OF MEDICAID EXPANSION.

(a) In General.–Section 1902(a)(10)(A) of the Social Security Act

(42 U.S.C. 1396a(a)(10)(A)) is amended–

(1) in clause (i)(VIII), by inserting “at the option of a

State,” after “January 1, 2014,”; and

(2) in clause (ii)(XX), by inserting “and ending December

31, 2019,” after “2014,”.

(b) Termination of EFMAP for New ACA Expansion Enrollees.–Section

1905 of the Social Security Act (42 U.S.C. 1396d) is amended–

(1) in subsection (y)(1), in the matter preceding

subparagraph (A), by striking “with respect to” and all that

follows through “shall be” and inserting “with respect to

amounts expended before January 1, 2020, by such State for

medical assistance for newly eligible individuals described in

subclause (VIII) of section 1902(a)(10)(A)(i) who are enrolled

under the State plan (or a waiver of the plan) before such date

and with respect to amounts expended after such date by such

State for medical assistance for individuals described in such

subclause who were enrolled under such plan (or waiver of such

plan) as of December 31, 2019, and who do not have a break in

eligibility for medical assistance under such State plan (or

waiver) for more than one month after such date, shall be”;

and

(2) in subsection (z)(2)–

(A) in subparagraph (A), by striking “medical

assistance for individuals” and all that follows

through “shall be” and inserting “amounts expended

before January 1, 2020, by such State for medical

assistance for individuals described in section

1902(a)(10)(A)(i)(VIII) who are nonpregnant childless

adults with respect to whom the State may require

enrollment in benchmark coverage under section 1937 and

who are enrolled under the State plan (or a waiver of

the plan) before such date and with respect to amounts

expended after such date by such State for medical

assistance for individuals described in such section,

who are nonpregnant childless adults with respect to

whom the State may require enrollment in benchmark

coverage under section 1937, who were enrolled under

such plan (or waiver of such plan) as of December 31,

2019, and who do not have a break in eligibility for

medical assistance under such State plan (or waiver)

for more than one month after such date, shall be”;

and

(B) in subparagraph (B)(ii)–

(i) in subclause (III), by adding “and”

at the end; and

(ii) by striking subclauses (IV), (V), and

(VI) and inserting the following new subclause:

“(IV) 2017 and each subsequent year is 80

percent.”.

(c) Sunset of Essential Health Benefits Requirement.–Section

1937(b)(5) of the Social Security Act (42 U.S.C. 1396u-7(b)(5)) is

amended by adding at the end the following: “This paragraph shall not

apply after December 31, 2019.”.

SEC. 113. ELIMINATION OF DSH CUTS.

Section 1923(f) of the Social Security Act (42 U.S.C. 1396r-4(f))

is amended–

(1) in paragraph (7)–

(A) in subparagraph (A)–

(i) in clause (i)–

(I) in the matter preceding

subclause (I), by striking “2025” and

inserting “2019”; and

(ii) in clause (ii)–

(I) in subclause (I), by adding

“and” at the end;

(II) in subclause (II), by striking

the semicolon at the end and inserting

a period; and

(III) by striking subclauses (III)

through (VIII); and

(B) by adding at the end the following new

subparagraph:

“(C) Exemption from exemption for non-expansion

states.–

“(i) In general.–In the case of a State

that is a non-expansion State for a fiscal

year, subparagraph (A)(i) shall not apply to

the DSH allotment for such State and fiscal

year.

“(ii) No change in reduction for expansion

states.–In the case of a State that is an

expansion State for a fiscal year, the DSH

allotment for such State and fiscal year shall

be determined as if clause (i) did not apply.

“(iii) Non-expansion and expansion state

defined.–

“(I) The term `expansion State’

means with respect to a fiscal year, a

State that, as of July 1 of the

preceding fiscal year, provides for

eligibility under clause (i)(VIII) or

(ii)(XX) of section 1902(a)(10)(A) for

medical assistance under this title (or

a waiver of the State plan approved

under section 1115).

“(II) The term `non-expansion

State’ means, with respect to a fiscal

year, a State that is not an expansion

State.”; and

(2) in paragraph (8), by striking “fiscal year 2025” and

inserting “fiscal year 2019”.

SEC. 114. REDUCING STATE MEDICAID COSTS.

(a) Letting States Disenroll High Dollar Lottery Winners.–

(1) In general.–Section 1902 of the Social Security Act

(42 U.S.C. 1396a) is amended–

(A) in subsection (a)(17), by striking “(e)(14),

(e)(14)” and inserting “(e)(14), (e)(15)”; and

(B) in subsection (e)–

(i) in paragraph (14) (relating to modified

adjusted gross income), by adding at the end

the following new subparagraph:

“(J) Treatment of certain lottery winnings and

income received as a lump sum.–

“(i) In general.–In the case of an

individual who is the recipient of qualified

lottery winnings (pursuant to lotteries

occurring on or after January 1, 2020) or

qualified lump sum income (received on or after

such date) and whose eligibility for medical

assistance is determined based on the

application of modified adjusted gross income

under subparagraph (A), a State shall, in

determining such eligibility, include such

winnings or income (as applicable) as income

received–

“(I) in the month in which such

winnings or income (as applicable) is

received if the amount of such winnings

or income is less than $80,000;

“(II) over a period of 2 months if

the amount of such winnings or income

(as applicable) is greater than or

equal to $80,000 but less than $90,000;

“(III) over a period of 3 months

if the amount of such winnings or

income (as applicable) is greater than

or equal to $90,000 but less than

$100,000; and

“(IV) over a period of 3 months

plus 1 additional month for each

increment of $10,000 of such winnings

or income (as applicable) received, not

to exceed a period of 120 months (for

winnings or income of $1,260,000 or

more), if the amount of such winnings

or income is greater than or equal to

$100,000.

“(ii) Counting in equal installments.–For

purposes of subclauses (II), (III), and (IV) of

clause (i), winnings or income to which such

subclause applies shall be counted in equal

monthly installments over the period of months

specified under such subclause.

“(iii) Hardship exemption.–An individual

whose income, by application of clause (i),

exceeds the applicable eligibility threshold

established by the State, may continue to be

eligible for medical assistance to the extent

that the State determines, under procedures

established by the State under the State plan

(or in the case of a waiver of the plan under

section 1115, incorporated in such waiver), or

as otherwise established by such State in

accordance with such standards as may be

specified by the Secretary, that the denial of

eligibility of the individual would cause an

undue medical or financial hardship as

determined on the basis of criteria established

by the Secretary.

“(iv) Notifications and assistance

required in case of loss of eligibility.–A

State shall, with respect to an individual who

loses eligibility for medical assistance under

the State plan (or a waiver of such plan) by

reason of clause (i), before the date on which

the individual loses such eligibility, inform

the individual of the date on which the

individual would no longer be considered

ineligible by reason of such clause to receive

medical assistance under the State plan or

under any waiver of such plan and the date on

which the individual would be eligible to

reapply to receive such medical assistance.

“(v) Qualified lottery winnings defined.–

In this subparagraph, the term `qualified

lottery winnings’ means winnings from a

sweepstakes, lottery, or pool described in

paragraph (3) of section 4402 of the Internal

Revenue Code of 1986 or a lottery operated by a

multistate or multijurisdictional lottery

association, including amounts awarded as a

lump sum payment.

“(vi) Qualified lump sum income defined.–

In this subparagraph, the term `qualified lump

sum income’ means income that is received as a

lump sum from one of the following sources:

“(I) Monetary winnings from

gambling (as defined by the Secretary

and including monetary winnings from

gambling activities described in

section 1955(b)(4) of title 18, United

States Code).

“(II) Income received as liquid

assets from the estate (as defined in

section 1917(b)(4)) of a deceased

individual.”; and

(ii) by striking “(14) Exclusion” and

inserting “(15) Exclusion”.

(2) Rules of construction.–

(A) Interception of lottery winnings allowed.–

Nothing in the amendment made by paragraph (1)(B)(i)

shall be construed as preventing a State from

intercepting the State lottery winnings awarded to an

individual in the State to recover amounts paid by the

State under the State Medicaid plan under title XIX of

the Social Security Act for medical assistance

furnished to the individual.

(B) Applicability limited to eligibility of

recipient of lottery winnings or lump sum income.–

Nothing in the amendment made by paragraph (1)(B)(i)

shall be construed, with respect to a determination of

household income for purposes of a determination of

eligibility for medical assistance under the State plan

under title XIX of the Social Security Act (42 U.S.C.

1396 et seq.) (or a waiver of such plan) made by

applying modified adjusted gross income under

subparagraph (A) of section 1902(e)(14) of such Act (42

U.S.C. 1396a(e)(14)), as limiting the eligibility for

such medical assistance of any individual that is a

member of the household other than the individual (or

the individual’s spouse) who received qualified lottery

winnings or qualified lump-sum income (as defined in

subparagraph (J) of such section 1902(e)(14), as added

by paragraph (1)(B)(i) of this subsection).

(b) Repeal of Retroactive Eligibility.–

(1) In general.–

(A) State plan requirements.–Section 1902(a)(34)

of the Social Security Act (42 U.S.C. 1396a(a)(34)) is

amended by striking “in or after the third month

before the month in which he made application” and

inserting “in or after the month in which the

individual made application”.

(B) Definition of medical assistance.–Section

1905(a) of the Social Security Act (42 U.S.C. 1396d(a))

is amended by striking “in or after the third month

before the month in which the recipient makes

application for assistance” and inserting “in or

after the month in which the recipient makes

application for assistance”.

(2) Effective date.–The amendments made by paragraph (1)

shall apply to medical assistance with respect to individuals

whose eligibility for such assistance is based on an

application for such assistance made (or deemed to be made) on

or after October 1, 2017.

(c) Ensuring States Are Not Forced to Pay for Individuals

Ineligible for the Program.–

(1) In general.–Section 1137(f) of the Social Security Act

(42 U.S.C. 1320b-7(f)) is amended–

(A) by striking “Subsections (a)(1) and (d)” and

inserting “(1) Subsections (a)(1) and (d)”; and

(B) by adding at the end the following new

paragraph:

“(2)(A) Subparagraphs (A) and (B)(ii) of subsection (d)(4) shall

not apply in the case of an initial determination made on or after the

date that is 6 months after the date of the enactment of this paragraph

with respect to the eligibility of an alien described in subparagraph

(B) for benefits under the program listed in subsection (b)(2).

“(B) An alien described in this subparagraph is an individual

declaring to be a citizen or national of the United States with respect

to whom a State, in accordance with section 1902(a)(46)(B), requires–

“(i) pursuant to 1902(ee), the submission of a social

security number; or

“(ii) pursuant to 1903(x), the presentation of

satisfactory documentary evidence of citizenship or

nationality.”.

(2) No payments for medical assistance provided before

presentation of evidence.–Section 1903(i)(22) of the Social

Security Act (42 U.S.C. 1396b(i)(22)) is amended–

(A) by striking “with respect to amounts

expended” and inserting “(A) with respect to amounts

expended”;

(B) by inserting “and” at the end; and

(C) by adding at the end the following new

subparagraph:

“(B) in the case of a State that elects to provide a

reasonable period to present satisfactory documentary evidence

of such citizenship or nationality pursuant to paragraph (2)(C)

of section 1902(ee) or paragraph (4) of subsection (x) of this

section, for amounts expended for medical assistance for such

an individual (other than an individual described in paragraph

(2) of such subsection (x)) during such period;”.

(3) Conforming amendments.–Section 1137(d)(4) of the

Social Security Act (42 U.S.C. 1320b-7(d)(4)) is amended–

(A) in subparagraph (A), in the matter preceding

clause (i), by inserting “subject to subsection

(f)(2),” before “the State”; and

(B) in subparagraph (B)(ii), by inserting “subject

to subsection (f)(2),” before “pending such

verification”.

(d) Updating Allowable Home Equity Limits in Medicaid.–

(1) In general.–Section 1917(f)(1) of the Social Security

Act (42 U.S.C. 1396p(f)(1)) is amended–

(A) in subparagraph (A), by striking

“subparagraphs (B) and (C)” and inserting

“subparagraph (B)”;

(B) by striking subparagraph (B);

(C) by redesignating subparagraph (C) as

subparagraph (B); and

(D) in subparagraph (B), as so redesignated, by

striking “dollar amounts specified in this paragraph”

and inserting “dollar amount specified in subparagraph

(A)”.

(2) Effective date.–

(A) In general.–The amendments made by paragraph

(1) shall apply with respect to eligibility

determinations made after the date that is 180 days

after the date of the enactment of this section.

(B) Exception for state legislation.–In the case

of a State plan under title XIX of the Social Security

Act that the Secretary of Health and Human Services

determines requires State legislation in order for the

respective plan to meet any requirement imposed by

amendments made by this subsection, the respective plan

shall not be regarded as failing to comply with the

requirements of such title solely on the basis of its

failure to meet such an additional requirement before

the first day of the first calendar quarter beginning

after the close of the first regular session of the

State legislature that begins after the date of the

enactment of this Act. For purposes of the previous

sentence, in the case of a State that has a 2-year

legislative session, each year of the session shall be

considered to be a separate regular session of the

State legislature.

SEC. 115. SAFETY NET FUNDING FOR NON-EXPANSION STATES.

Title XIX of the Social Security Act is amended by inserting after

section 1923 (42 U.S.C. 1396r-4) the following new section:

“adjustment in payment for services of safety net providers in non-

expansion states

“Sec. 1923A. (a) In General.–Subject to the limitations of this

section, for each year during the period beginning with 2018 and ending

with 2021, each State that is one of the 50 States or the District of

Columbia and that, as of July 1 of the preceding year, did not provide

for eligibility under clause (i)(VIII) or (ii)(XX) of section

1902(a)(10)(A) for medical assistance under this title (or a waiver of

the State plan approved under section 1115) (each such State or

District referred to in this section for the year as a `non-expansion

State’) may adjust the payment amounts otherwise provided under the

State plan under this title (or a waiver of such plan) to health care

providers that provide health care services to individuals enrolled

under this title (in this section referred to as `eligible providers’).

“(b) Increase in Applicable FMAP.–Notwithstanding section

1905(b), the Federal medical assistance percentage applicable with

respect to expenditures attributable to a payment adjustment under

subsection (a) for which payment is permitted under subsection (c)

shall be equal to–

“(1) 100 percent for calendar quarters in calendar years

2018, 2019, 2020, and 2021; and

“(2) 95 percent for calendar quarters in calendar year

2022.

“(c) Limitations; Disqualification of States.–

“(1) Annual allotment limitation.–Payment under section

1903(a) shall not be made to a State with respect to any

payment adjustment made under this section for all calendar

quarters in a year in excess of the $2,000,000,000 multiplied

by the ratio of–

“(A) the population of the State with income below

138 percent of the poverty line in 2015 (as determined

based the table entitled `Health Insurance Coverage

Status and Type by Ratio of Income to Poverty Level in

the Past 12 Months by Age’ for the universe of the

civilian noninstitutionalized population for whom

poverty status is determined based on the 2015 American

Community Survey 1-Year Estimates, as published by the

Bureau of the Census), to

“(B) the sum of the populations under subparagraph

(A) for all non-expansion States.

“(2) Limitation on payment adjustment amount for

individual providers.–The amount of a payment adjustment under

subsection (a) for an eligible provider may not exceed the

provider’s costs incurred in furnishing health care services

(as determined by the Secretary and net of payments under this

title, other than under this section, and by uninsured

patients) to individuals who either are eligible for medical

assistance under the State plan (or under a waiver of such

plan) or have no health insurance or health plan coverage for

such services.

“(d) Disqualification in Case of State Coverage Expansion.–If a

State is a non-expansion for a year and provides eligibility for

medical assistance described in subsection (a) during the year, the

State shall no longer be treated as a non-expansion State under this

section for any subsequent years.”.

SEC. 116. PROVIDING INCENTIVES FOR INCREASED FREQUENCY OF ELIGIBILITY

REDETERMINATIONS.

(a) In General.–Section 1902(e)(14) of the Social Security Act (42

U.S.C. 1396a(e)(14)) (relating to modified adjusted gross income), as

amended by section 114(a)(1), is further amended by adding at the end

the following:

“(K) Frequency of eligibility redeterminations.–

Beginning on October 1, 2017, and notwithstanding

subparagraph (H), in the case of an individual whose

eligibility for medical assistance under the State plan

under this title (or a waiver of such plan) is

determined based on the application of modified

adjusted gross income under subparagraph (A) and who is

so eligible on the basis of clause (i)(VIII) or clause

(ii)(XX) of subsection (a)(10)(A), a State shall

redetermine such individual’s eligibility for such

medical assistance no less frequently than once every 6

months.”.

(b) Civil Monetary Penalty.–Section 1128A(a) of the Social

Security Act (42 U.S.C. 1320a-7a(a)) is amended, in the matter

following paragraph (10), by striking “(or, in cases under paragraph

(3)” and inserting the following: “(or, in cases under paragraph (1)

in which an individual was knowingly enrolled on or after October 1,

2017, pursuant to section 1902(a)(10)(A)(i)(VIII) for medical

assistance under the State plan under title XIX whose income does not

meet the income threshold specified in such section or in which a claim

was presented on or after October 1, 2017, as a claim for an item or

service furnished to an individual described in such section but whose

enrollment under such State plan is not made on the basis of such

individual’s meeting the income threshold specified in such section,

$20,000 for each such individual or claim; in cases under paragraph

(3)”.

(c) Increased Administrative Matching Percentage.–For each

calendar quarter during the period beginning on October 1, 2017, and

ending on December 31, 2019, the Federal matching percentage otherwise

applicable under section 1903(a) of the Social Security Act (42 U.S.C.

1396b(a)) with respect to State expenditures during such quarter that

are attributable to meeting the requirement of section 1902(e)(14)

(relating to determinations of eligibility using modified adjusted

gross income) of such Act shall be increased by 5 percentage points

with respect to State expenditures attributable to activities carried

out by the State (and approved by the Secretary) to increase the

frequency of eligibility redeterminations required by subparagraph (K)

of such section (relating to eligibility redeterminations made on a 6-

month basis) (as added by subsection (a)).

Subtitle C–Per Capita Allotment for Medical Assistance

SEC. 121. PER CAPITA ALLOTMENT FOR MEDICAL ASSISTANCE.

Title XIX of the Social Security Act is amended–

(1) in section 1903 (42 U.S.C. 1396b)–

(A) in subsection (a), in the matter before

paragraph (1), by inserting “and section 1903A(a)”

after “except as otherwise provided in this section”;

and

(B) in subsection (d)(1), by striking “to which”

and inserting “to which, subject to section

1903A(a),”; and

(2) by inserting after such section 1903 the following new

section:

“SEC. 1903A. PER CAPITA-BASED CAP ON PAYMENTS FOR MEDICAL ASSISTANCE.

“(a) Application of Per Capita Cap on Payments for Medical

Assistance Expenditures.–

“(1) In general.–If a State has excess aggregate medical

assistance expenditures (as defined in paragraph (2)) for a

fiscal year (beginning with fiscal year 2020), the amount of

payment to the State under section 1903(a)(1) for each quarter

in the following fiscal year shall be reduced by \1/4\ of the

excess aggregate medical assistance payments (as defined in

paragraph (3)) for that previous fiscal year. In this section,

the term `State’ means only the 50 States and the District of

Columbia.

“(2) Excess aggregate medical assistance expenditures.–In

this subsection, the term `excess aggregate medical assistance

expenditures’ means, for a State for a fiscal year, the amount

(if any) by which–

“(A) the amount of the adjusted total medical

assistance expenditures (as defined in subsection

(b)(1)) for the State and fiscal year; exceeds

“(B) the amount of the target total medical

assistance expenditures (as defined in subsection (c))

for the State and fiscal year.

“(3) Excess aggregate medical assistance payments.–In

this subsection, the term `excess aggregate medical assistance

payments’ means, for a State for a fiscal year, the product

of–

“(A) the excess aggregate medical assistance

expenditures (as defined in paragraph (2)) for the

State for the fiscal year; and

“(B) the Federal average medical assistance

matching percentage (as defined in paragraph (4)) for

the State for the fiscal year.

“(4) Federal average medical assistance matching

percentage.–In this subsection, the term `Federal average

medical assistance matching percentage’ means, for a State for

a fiscal year, the ratio (expressed as a percentage) of–

“(A) the amount of the Federal payments that would

be made to the State under section 1903(a)(1) for

medical assistance expenditures for calendar quarters

in the fiscal year if paragraph (1) did not apply; to

“(B) the amount of the medical assistance

expenditures for the State and fiscal year.

“(b) Adjusted Total Medical Assistance Expenditures.–Subject to

subsection (g), the following shall apply:

“(1) In general.–In this section, the term `adjusted

total medical assistance expenditures’ means, for a State–

“(A) for fiscal year 2016, the product of–

“(i) the amount of the medical assistance

expenditures (as defined in paragraph (2)) for

the State and fiscal year, reduced by the

amount of any excluded expenditures (as defined

in paragraph (3)) for the State and fiscal year

otherwise included in such medical assistance

expenditures; and

“(ii) the 1903A FY16 population percentage

(as defined in paragraph (4)) for the State; or

“(B) for fiscal year 2019 or a subsequent fiscal

year, the amount of the medical assistance expenditures

(as defined in paragraph (2)) for the State and fiscal

year that is attributable to 1903A enrollees, reduced

by the amount of any excluded expenditures (as defined

in paragraph (3)) for the State and fiscal year

otherwise included in such medical assistance

expenditures.

“(2) Medical assistance expenditures.–In this section,

the term `medical assistance expenditures’ means, for a State

and fiscal year, the medical assistance payments as reported by

medical service category on the Form CMS-64 quarterly expense

report (or successor to such a report form, and including

enrollment data and subsequent adjustments to any such report,

in this section referred to collectively as a `CMS-64 report’)

that directly result from providing medical assistance under

the State plan (including under a waiver of the plan) for which

payment is (or may otherwise be) made pursuant to section

1903(a)(1).

“(3) Excluded expenditures.–In this section, the term

`excluded expenditures’ means, for a State and fiscal year,

expenditures under the State plan (or under a waiver of such

plan) that are attributable to any of the following:

“(A) DSH.–Payment adjustments made for

disproportionate share hospitals under section 1923.

“(B) Medicare cost-sharing.–Payments made for

medicare cost-sharing (as defined in section

1905(p)(3)).

“(C) Safety net provider payment adjustments in

non-expansion states.–Payment adjustments under

subsection (a) of section 1923A for which payment is

permitted under subsection (c) of such section.

“(4) 1903A fy 16 population percentage.–In this

subsection, the term `1903A FY16 population percentage’ means,

for a State, the Secretary’s calculation of the percentage of

the actual medical assistance expenditures, as reported by the

State on the CMS-64 reports for calendar quarters in fiscal

year 2016, that are attributable to 1903A enrollees (as defined

in subsection (e)(1)).

“(c) Target Total Medical Assistance Expenditures.–

“(1) Calculation.–In this section, the term `target total

medical assistance expenditures’ means, for a State for a

fiscal year, the sum of the products, for each of the 1903A

enrollee categories (as defined in subsection (e)(2)), of–

“(A) the target per capita medical assistance

expenditures (as defined in paragraph (2)) for the

enrollee category, State, and fiscal year; and

“(B) the number of 1903A enrollees for such

enrollee category, State, and fiscal year, as

determined under subsection (e)(4).

“(2) Target per capita medical assistance expenditures.–

In this subsection, the term `target per capita medical

assistance expenditures’ means, for a 1903A enrollee category,

State, and a fiscal year, an amount equal to–

“(A) the provisional FY19 target per capita amount

for such enrollee category (as calculated under

subsection (d)(5)) for the State; increased by

“(B) the percentage increase in the medical care

component of the consumer price index for all urban

consumers (U.S. city average) from September of 2019 to

September of the fiscal year involved.

“(d) Calculation of FY19 Provisional Target Amount for Each 1903A

Enrollee Category.–Subject to subsection (g), the following shall

apply:

“(1) Calculation of base amounts for fiscal year 2016.–

For each State the Secretary shall calculate (and provide

notice to the State not later than April 1, 2018, of) the

following:

“(A) The amount of the adjusted total medical

assistance expenditures (as defined in subsection

(b)(1)) for the State for fiscal year 2016.

“(B) The number of 1903A enrollees for the State

in fiscal year 2016 (as determined under subsection

(e)(4)).

“(C) The average per capita medical assistance

expenditures for the State for fiscal year 2016 equal

to–

“(i) the amount calculated under

subparagraph (A); divided by

“(ii) the number calculated under

subparagraph (B).

“(2) Fiscal year 2019 average per capita amount based on

inflating the fiscal year 2016 amount to fiscal year 2019 by

cpi-medical.–The Secretary shall calculate a fiscal year 2019

average per capita amount for each State equal to–

“(A) the average per capita medical assistance

expenditures for the State for fiscal year 2016

(calculated under paragraph (1)(C)); increased by

“(B) the percentage increase in the medical care

component of the consumer price index for all urban

consumers (U.S. city average) from September, 2016 to

September, 2019.

“(3) Aggregate and average expenditures per capita for

fiscal year 2019.–The Secretary shall calculate for each State

the following:

“(A) The amount of the adjusted total medical

assistance expenditures (as defined in subsection

(b)(1)) for the State for fiscal year 2019.

“(B) The number of 1903A enrollees for the State

in fiscal year 2019 (as determined under subsection

(e)(4)).

“(4) Per capita expenditures for fiscal year 2019 for each

1903a enrollee category.–The Secretary shall calculate (and

provide notice to each State not later than January 1, 2020,

of) the following:

“(A)(i) For each 1903A enrollee category, the

amount of the adjusted total medical assistance

expenditures (as defined in subsection (b)(1)) for the

State for fiscal year 2019 for individuals in the

enrollee category, calculated by excluding from medical

assistance expenditures those expenditures attributable

to expenditures described in clause (iii) or non-DSH

supplemental expenditures (as defined in clause (ii)).

“(ii) In this paragraph, the term `non-DSH

supplemental expenditure’ means a payment to a provider

under the State plan (or under a waiver of the plan)

that–

“(I) is not made under section 1923;

“(II) is not made with respect to a

specific item or service for an individual;

“(III) is in addition to any payments made

to the provider under the plan (or waiver) for

any such item or service; and

“(IV) complies with the limits for

additional payments to providers under the plan

(or waiver) imposed pursuant to section

1902(a)(30)(A), including the regulations

specifying upper payment limits under the State

plan in part 447 of title 42, Code of Federal

Regulations (or any successor regulations).

“(iii) An expenditure described in this clause is

an expenditure that meets the criteria specified in

subclauses (I), (II), and (III) of clause (ii) and is

authorized under section 1115 for the purposes of

funding a delivery system reform pool, uncompensated

care pool, a designated state health program, or any

other similar expenditure (as defined by the

Secretary).

“(B) For each 1903A enrollee category, the number

of 1903A enrollees for the State in fiscal year 2019 in

the enrollee category (as determined under subsection

(e)(4)).

“(C) For fiscal year 2016, the State’s non-DSH

supplemental payment percentage is equal to the ratio

(expressed as a percentage) of–

“(i) the total amount of non-DSH

supplemental expenditures (as defined in

subparagraph (A)(ii)) for the State for fiscal

year 2016; to

“(ii) the amount described in subsection

(b)(1)(A) for the State for fiscal year 2016.

“(D) For each 1903A enrollee category an average

medical assistance expenditures per capita for the

State for fiscal year 2019 for the enrollee category

equal to–

“(i) the amount calculated under

subparagraph (A) for the State, increased by

the non-DSH supplemental payment percentage for

the State (as calculated under subparagraph

(C)); divided by

“(ii) the number calculated under

subparagraph (B) for the State for the enrollee

category.

“(5) Provisional fy19 per capita target amount for each

1903a enrollee category.–Subject to subsection (f)(2), the

Secretary shall calculate for each State a provisional FY19 per

capita target amount for each 1903A enrollee category equal to

the average medical assistance expenditures per capita for the

State for fiscal year 2019 (as calculated under paragraph

(4)(D)) for such enrollee category multiplied by the ratio of–

“(A) the product of–

“(i) the fiscal year 2019 average per

capita amount for the State, as calculated

under paragraph (2); and

“(ii) the number of 1903A enrollees for

the State in fiscal year 2019, as calculated

under paragraph (3)(B); to

“(B) the amount of the adjusted total medical

assistance expenditures for the State for fiscal year

2019, as calculated under paragraph (3)(A).

“(e) 1903A Enrollee; 1903A Enrollee Category.–Subject to

subsection (g), for purposes of this section, the following shall

apply:

“(1) 1903A enrollee.–The term `1903A enrollee’ means,

with respect to a State and a month, any Medicaid enrollee (as

defined in paragraph (3)) for the month, other than such an

enrollee who for such month is in any of the following

categories of excluded individuals:

“(A) CHIP.–An individual who is provided, under

this title in the manner described in section

2101(a)(2), child health assistance under title XXI.

“(B) IHS.–An individual who receives any medical

assistance under this title for services for which

payment is made under the third sentence of section

1905(b).

“(C) Breast and cervical cancer services eligible

individual.–An individual who is entitled to medical

assistance under this title only pursuant to section

1902(a)(10)(A)(ii)(XVIII).

“(D) Partial-benefit enrollees.–An individual

who–

“(i) is an alien who is entitled to

medical assistance under this title only

pursuant to section 1903(v)(2);

“(ii) is entitled to medical assistance

under this title only pursuant to subclause

(XII) or (XXI) of section 1902(a)(10)(A)(ii)

(or pursuant to a waiver that provides only

comparable benefits);

“(iii) is a dual eligible individual (as

defined in section 1915(h)(2)(B)) and is

entitled to medical assistance under this title

(or under a waiver) only for some or all of

medicare cost-sharing (as defined in section

1905(p)(3)); or

“(iv) is entitled to medical assistance

under this title and for whom the State is

providing a payment or subsidy to an employer

for coverage of the individual under a group

health plan pursuant to section 1906 or section

1906A (or pursuant to a waiver that provides

only comparable benefits).

“(2) 1903A enrollee category.–The term `1903A enrollee

category’ means each of the following:

“(A) Elderly.–A category of 1903A enrollees who

are 65 years of age or older.

“(B) Blind and disabled.–A category of 1903A

enrollees (not described in the previous subparagraph)

who are eligible for medical assistance under this

title on the basis of being blind or disabled.

“(C) Children.–A category of 1903A enrollees (not

described in a previous subparagraph) who are children

under 19 years of age.

“(D) Expansion enrollees.–A category of 1903A

enrollees (not described in a previous subparagraph)

for whom the amounts expended for medical assistance

are subject to an increase or change in the Federal

medical assistance percentage under subsection (y) or

(z)(2), respectively, of section 1905.

“(E) Other nonelderly, nondisabled, non-expansion

adults.–A category of 1903A enrollees who are not

described in any previous subparagraph.

“(3) Medicaid enrollee.–The term `Medicaid enrollee’

means, with respect to a State for a month, an individual who

is eligible for medical assistance for items or services under

this title and enrolled under the State plan (or a waiver of

such plan) under this title for the month.

“(4) Determination of number of 1903a enrollees.–The

number of 1903A enrollees for a State and fiscal year, and, if

applicable, for a 1903A enrollee category, is the average

monthly number of Medicaid enrollees for such State and fiscal

year (and, if applicable, in such category) that are reported

through the CMS-64 report under (and subject to audit under)

subsection (h).

“(f) Special Payment Rules.–

“(1) Application in case of research and demonstration

projects and other waivers.–In the case of a State with a

waiver of the State plan approved under section 1115, section

1915, or another provision of this title, this section shall

apply to medical assistance expenditures and medical assistance

payments under the waiver, in the same manner as if such

expenditures and payments had been made under a State plan

under this title and the limitations on expenditures under this

section shall supersede any other payment limitations or

provisions (including limitations based on a per capita

limitation) otherwise applicable under such a waiver.

“(2) Treatment of states expanding coverage after fiscal

year 2016.–In the case of a State that did not provide for

medical assistance for the 1903A enrollee category described in

subsection (e)(2)(D) during fiscal year 2016 but which provides

for such assistance for such category in a subsequent year, the

provisional FY19 per capita target amount for such enrollee

category under subsection (d)(5) shall be equal to the

provisional FY19 per capita target amount for the 1903A

enrollee category described in subsection (e)(2)(E).

“(3) In case of state failure to report necessary data.–

If a State for any quarter in a fiscal year (beginning with

fiscal year 2019) fails to satisfactorily submit data on

expenditures and enrollees in accordance with subsection

(h)(1), for such fiscal year and any succeeding fiscal year for

which such data are not satisfactorily submitted–

“(A) the Secretary shall calculate and apply

subsections (a) through (e) with respect to the State

as if all 1903A enrollee categories for which such

expenditure and enrollee data were not satisfactorily

submitted were a single 1903A enrollee category; and

“(B) the growth factor otherwise applied under

subsection (c)(2)(B) shall be decreased by 1 percentage

point.

“(g) Recalculation of Certain Amounts for Data Errors.–The

amounts and percentage calculated under paragraphs (1) and (4)(C) of

subsection (d) for a State for fiscal year 2016, and the amounts of the

adjusted total medical assistance expenditures calculated under

subsection (b) and the number of Medicaid enrollees and 1903A enrollees

determined under subsection (e)(4) for a State for fiscal year 2016,

fiscal year 2019, and any subsequent fiscal year, may be adjusted by

the Secretary based upon an appeal (filed by the State in such a form,

manner, and time, and containing such information relating to data

errors that support such appeal, as the Secretary specifies) that the

Secretary determines to be valid, except that any adjustment by the

Secretary under this subsection for a State may not result in an

increase of the target total medical assistance expenditures exceeding

2 percent.

“(h) Required Reporting and Auditing of CMS-64 Data; Transitional

Increase in Federal Matching Percentage for Certain Administrative

Expenses.–

“(1) Reporting.–In addition to the data required on form

Group VIII on the CMS-64 report form as of January 1, 2017, in

each CMS-64 report required to be submitted (for each quarter

beginning on or after October 1, 2018), the State shall include

data on medical assistance expenditures within such categories

of services and categories of enrollees (including each 1903A

enrollee category and each category of excluded individuals

under subsection (e)(1)) and the numbers of enrollees within

each of such enrollee categories, as the Secretary determines

are necessary (including timely guidance published as soon as

possible after the date of the enactment of this section) in

order to implement this section and to enable States to comply

with the requirement of this paragraph on a timely basis.

“(2) Auditing.–The Secretary shall conduct for each State

an audit of the number of individuals and expenditures reported

through the CMS-64 report for fiscal year 2016, fiscal year

2019, and each subsequent fiscal year, which audit may be

conducted on a representative sample (as determined by the

Secretary).

“(3) Temporary increase in federal matching percentage to

support improved data reporting systems for fiscal years 2018

and 2019.–For amounts expended during calendar quarters

beginning on or after October 1, 2017, and before October 1,

2019–

“(A) the Federal matching percentage applied under

section 1903(a)(3)(A)(i) shall be increased by 10

percentage points to 100 percent;

“(B) the Federal matching percentage applied under

section 1903(a)(3)(B) shall be increased by 25

percentage points to 100 percent; and

“(C) the Federal matching percentage applied under

section 1903(a)(7) shall be increased by 10 percentage

points to 60 percent but only with respect to amounts

expended that are attributable to a State’s additional

administrative expenditures to implement the data

requirements of paragraph (1).”.

Subtitle D–Patient Relief and Health Insurance Market Stability

SEC. 131. REPEAL OF COST-SHARING SUBSIDY.

(a) In General.–Section 1402 of the Patient Protection and

Affordable Care Act is repealed.

(b) Effective Date.–The repeal made by subsection (a) shall apply

to cost-sharing reductions (and payments to issuers for such

reductions) for plan years beginning after December 31, 2019.

SEC. 132. PATIENT AND STATE STABILITY FUND.

The Social Security Act (42 U.S.C. 301 et seq.) is amended by

adding at the end the following new title:

“TITLE XXII–PATIENT AND STATE STABILITY FUND

“SEC. 2201. ESTABLISHMENT OF PROGRAM.

“There is hereby established the `Patient and State Stability

Fund’ to be administered by the Secretary of Health and Human Services,

acting through the Administrator of the Centers for Medicare & Medicaid

Services (in this section referred to as the `Administrator’), to

provide funding, in accordance with this title, to the 50 States and

the District of Columbia (each referred to in this section as a

`State’) during the period, subject to section 2204(c), beginning on

January 1, 2018, and ending on December 31, 2026, for the purposes

described in section 2202.

“SEC. 2202. USE OF FUNDS.

“A State may use the funds allocated to the State under this title

for any of the following purposes:

“(1) Helping, through the provision of financial

assistance, high-risk individuals who do not have access to

health insurance coverage offered through an employer enroll in

health insurance coverage in the individual market in the

State, as such market is defined by the State (whether through

the establishment of a new mechanism or maintenance of an

existing mechanism for such purpose).

“(2) Providing incentives to appropriate entities to enter

into arrangements with the State to help stabilize premiums for

health insurance coverage in the individual market, as such

markets are defined by the State.

“(3) Reducing the cost for providing health insurance

coverage in the individual market and small group market, as

such markets are defined by the State, to individuals who have,

or are projected to have, a high rate of utilization of health

services (as measured by cost).

“(4) Promoting participation in the individual market and

small group market in the State and increasing health insurance

options available through such market.

“(5) Promoting access to preventive services; dental care

services (whether preventive or medically necessary); vision

care services (whether preventive or medically necessary);

prevention, treatment, or recovery support services for

individuals with mental or substance use disorders; or any

combination of such services.

“(6) Providing payments, directly or indirectly, to health

care providers for the provision of such health care services

as are specified by the Administrator.

“(7) Providing assistance to reduce out-of-pocket costs,

such as copayments, coinsurance, premiums, and deductibles, of

individuals enrolled in health insurance coverage in the State.

“SEC. 2203. STATE ELIGIBILITY AND APPROVAL; DEFAULT SAFEGUARD.

“(a) Encouraging State Options for Allocations.–

“(1) In general.–To be eligible for an allocation of

funds under this title for a year during the period described

in section 2201 for use for one or more purposes described in

section 2202, a State shall submit to the Administrator an

application at such time (but, in the case of allocations for

2018, not later than 45 days after the date of the enactment of

this title and, in the case of allocations for a subsequent

year, not later than March 31 of the previous year) and in such

form and manner as specified by the Administrator and

containing–

“(A) a description of how the funds will be used

for such purposes;

“(B) a certification that the State will make,

from non-Federal funds, expenditures for such purposes

in an amount that is not less than the State percentage

required for the year under section 2204(e)(1); and

“(C) such other information as the Administrator

may require.

“(2) Automatic approval.–An application so submitted is

approved unless the Administrator notifies the State submitting

the application, not later than 60 days after the date of the

submission of such application, that the application has been

denied for not being in compliance with any requirement of this

title and of the reason for such denial.

“(3) One-time application.–If an application of a State

is approved for a year, with respect to a purpose described in

section 2202, such application shall be treated as approved,

with respect to such purpose, for each subsequent year through

2026.

“(4) Treatment as a state health care program.–Any

program receiving funds from an allocation for a State under

this title, including pursuant to subsection (b), shall be

considered to be a `State health care program’ for purposes of

sections 1128, 1128A, and 1128B.

“(b) Default Federal Safeguard.–

“(1) In general.–

“(A) 2018.–For allocations made under this title

for 2018, in the case of a State that does not submit

an application under subsection (a) by the 45-day

submission date applicable to such year under

subsection (a)(1) and in the case of a State that does

submit such an application by such date that is not

approved, subject to section 2204(e), the

Administrator, in consultation with the State insurance

commissioner, shall use the allocation that would

otherwise be provided to the State under this title for

such year, in accordance with paragraph (2), for such

State.

“(B) 2019 through 2026.–In the case of a State

that does not have in effect an approved application

under this section for 2019 or a subsequent year

beginning during the period described in section 2201,

subject to section 2204(e), the Administrator, in

consultation with the State insurance commissioner,

shall use the allocation that would otherwise be

provided to the State under this title for such year,

in accordance with paragraph (2), for such State.

“(2) Required use for market stabilization payments to

issuers.–Subject to section 2204(a), an allocation for a State

made pursuant to paragraph (1) for a year shall be used to

carry out the purpose described in section 2202(2) in such

State by providing payments to appropriate entities described

in such section with respect to claims that exceed $50,000 (or,

with respect to allocations made under this title for 2020 or a

subsequent year during the period specified in section 2201,

such dollar amount specified by the Administrator), but do not

exceed $350,000 (or, with respect to allocations made under

this title for 2020 or a subsequent year during such period,

such dollar amount specified by the Administrator), in an

amount equal to 75 percent (or, with respect to allocations

made under this title for 2020 or a subsequent year during such

period, such percentage specified by the Administrator) of the

amount of such claims.

“SEC. 2204. ALLOCATIONS.

“(a) Appropriation.–For the purpose of providing allocations for

States (including pursuant to section 2203(b)) under this title there

is appropriated, out of any money in the Treasury not otherwise

appropriated–

“(1) for 2018, $15,000,000,000;

“(2) for 2019, $15,000,000,000;

“(3) for 2020, $10,000,000,000;

“(4) for 2021, $10,000,000,000;

“(5) for 2022, $10,000,000,000;

“(6) for 2023, $10,000,000,000;

“(7) for 2024, $10,000,000,000;

“(8) for 2025, $10,000,000,000; and

“(9) for 2026, $10,000,000,000.

“(b) Allocations.–

“(1) Payment.–

“(A) In general.–From amounts appropriated under

subsection (a) for a year, the Administrator shall,

with respect to a State and not later than the date

specified under subparagraph (B) for such year,

allocate, subject to subsection (e), for such State

(including pursuant to section 2203(b)) the amount

determined for such State and year under paragraph (2).

“(B) Specified date.–For purposes of subparagraph

(A), the date specified in this subparagraph is–

“(i) for 2018, the date that is 45 days

after the date of the enactment of this title;

and

“(ii) for 2019 and subsequent years,

January 1 of the respective year.

“(2) Allocation amount determinations.–

“(A) For 2018 and 2019.–

“(i) In general.–For purposes of

paragraph (1), the amount determined under this

paragraph for 2018 and 2019 for a State is an

amount equal to the sum of–

“(I) the relative incurred claims

amount described in clause (ii) for

such State and year; and

“(II) the relative uninsured and

issuer participation amount described

in clause (iv) for such State and year.

“(ii) Relative incurred claims amount.–

For purposes of clause (i), the relative

incurred claims amount described in this clause

for a State for 2018 and 2019 is the product

of–

“(I) 85 percent of the amount

appropriated under subsection (a) for

the year; and

“(II) the relative State incurred

claims proportion described in clause

(iii) for such State and year.

“(iii) Relative state incurred claims

proportion.–The relative State incurred claims

proportion described in this clause for a State

and year is the amount equal to the ratio of–

“(I) the adjusted incurred claims

by the State, as reported through the

medical loss ratio annual reporting

under section 2718 of the Public Health

Service Act for the third previous

year; to

“(II) the sum of such adjusted

incurred claims for all States, as so

reported, for such third previous year.

“(iv) Relative uninsured and issuer

participation amount.–For purposes of clause

(i), the relative uninsured and issuer

participation amount described in this clause

for a State for 2018 and 2019 is the product

of–

“(I) 15 percent of the amount

appropriated under subsection (a) for

the year; and

“(II) the relative State uninsured

and issuer participation proportion

described in clause (v) for such State

and year.

“(v) Relative state uninsured and issuer

participation proportion.–The relative State

uninsured and issuer participation proportion

described in this clause for a State and year

is–

“(I) in the case of a State not

described in clause (vi) for such year,

0; and

“(II) in the case of a State

described in clause (vi) for such year,

the amount equal to the ratio of–

“(aa) the number of

individuals residing in such

State who for the third

preceding year were not

enrolled in a health plan or

otherwise did not have health

insurance coverage (including

through a Federal or State

health program) and whose

income is below 100 percent of

the poverty line applicable to

a family of the size involved;

to

“(bb) the sum of the

number of such individuals for

all States described in clause

(vi) for the third preceding

year.

“(vi) States described.–For purposes of

clause (v), a State is described in this

clause, with respect to 2018 and 2019, if the

State satisfies either of the following

criterion:

“(I) The number of individuals

residing in such State and described in

clause (v)(II)(aa) was higher in 2015

than 2013.

“(II) The State have fewer than

three health insurance issuers offering

qualified health plans through the

Exchange for 2017.

“(B) For 2020 through 2026.–For purposes of

paragraph (1), the amount determined under this

paragraph for a year (beginning with 2020) during the

period described in section 2201 for a State is an

amount determined in accordance with an allocation

methodology specified by the Administrator which–

“(i) takes into consideration the adjusted

incurred claims of such State, the number of

residents of such State who for the previous

year were not enrolled in a health plan or

otherwise did not have health insurance

coverage (including through a Federal or State

health program) and whose income is below 100

percent of the poverty line applicable to a

family of the size involved, and the number of

health insurance issuers participating in the

insurance market in such State for such year;

“(ii) is established after consultation

with health care consumers, health insurance

issuers, State insurance commissioners, and

other stakeholders and after taking into

consideration additional cost and risk factors

that may inhibit health care consumer and

health insurance issuer participation; and

“(iii) reflects the goals of improving the

health insurance risk pool, promoting a more

competitive health insurance market, and

increasing choice for health care consumers.

“(c) Annual Distribution of Previous Year’s Remaining Funds.– In

carrying out subsection (b), the Administrator shall, with respect to a

year (beginning with 2020 and ending with 2027), not later than March

31 of such year–

“(1) determine the amount of funds, if any, from the

amounts appropriated under subsection (a) for the previous year

but not allocated for such previous year; and

“(2) if the Administrator determines that any funds were

not so allocated for such previous year, allocate such

remaining funds, in accordance with the allocation methodology

specified pursuant to subsection (b)(2)(B)–

“(A) to States that have submitted an application

approved under section 2203(a) for such previous year

for any purpose for which such an application was

approved; and

“(B) for States for which allocations were made

pursuant to section 2203(b) for such previous year, to

be used by the Administrator for such States, to carry

out the purpose described in section 2202(2) in such

States by providing payments to appropriate entities

described in such section with respect to claims that

exceed $1,000,000;

with, respect to a year before 2027, any remaining funds being

made available for allocations to States for the subsequent

year.

“(d) Availability.–Amounts appropriated under subsection (a) for

a year and allocated to States in accordance with this section shall

remain available for expenditure through December 31, 2027.

“(e) Conditions for and Limitations on Receipt of Funds.–The

Secretary may not make an allocation under this title for a State, with

respect to a purpose described in section 2202–

“(1) in the case of an allocation that would be made to a

State pursuant to section 2203(a), if the State does not agree

that the State will make available non-Federal contributions

towards such purpose in an amount equal to–

“(A) for 2020, 7 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(B) for 2021, 14 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(C) for 2022, 21 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(D) for 2023, 28 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(E) for 2024, 35 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(F) for 2025, 42 percent of the amount allocated

under this subsection to such State for such year and

purpose; and

“(G) for 2026, 50 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(2) in the case of an allocation that would be made for a

State pursuant to section 2203(b), if the State does not agree

that the State will make available non-Federal contributions

towards such purpose in an amount equal to–

“(A) for 2020, 10 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(B) for 2021, 20 percent of the amount allocated

under this subsection to such State for such year and

purpose; and

“(C) for 2022, 30 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(D) for 2023, 40 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(E) for 2024, 50 percent of the amount allocated

under this subsection to such State for such year and

purpose;

“(F) for 2025, 50 percent of the amount allocated

under this subsection to such State for such year and

purpose; and

“(G) for 2026, 50 percent of the amount allocated

under this subsection to such State for such year and

purpose; or

“(3) if such an allocation for such purpose would not be

permitted under subsection (c)(7) of section 2105 if such

allocation were payment made under such section.”.

SEC. 133. CONTINUOUS HEALTH INSURANCE COVERAGE INCENTIVE.

Subpart I of part A of title XXVII of the Public Health Service Act

is amended–

(1) in section 2701(a)(1)(B), by striking “such rate” and

inserting “subject to section 2710A, such rate”;

(2) by redesignating the second section 2709 as section

2710; and

(3) by adding at the end the following new section:

“SEC. 2710A. ENCOURAGING CONTINUOUS HEALTH INSURANCE COVERAGE.

“(a) Penalty Applied.–

“(1) In general.–Notwithstanding section 2701, subject to

the succeeding provisions of this section, a health insurance

issuer offering health insurance coverage in the individual or

small group market shall, in the case of an individual who is

an applicable policyholder of such coverage with respect to an

enforcement period applicable to enrollments for a plan year

beginning with plan year 2019 (or, in the case of enrollments

during a special enrollment period, beginning with plan year

2018), increase the monthly premium rate otherwise applicable

to such individual for such coverage during each month of such

period, by an amount determined under paragraph (2).

“(2) Amount of penalty.–The amount determined under this

paragraph for an applicable policyholder enrolling in health

insurance coverage described in paragraph (1) for a plan year,

with respect to each month during the enforcement period

applicable to enrollments for such plan year, is the amount

that is equal to 30 percent of the monthly premium rate

otherwise applicable to such applicable policyholder for such

coverage during such month.

“(b) Definitions.–For purposes of this section:

“(1) Applicable policyholder.–The term `applicable

policyholder’ means, with respect to months of an enforcement

period and health insurance coverage, an individual who–

“(A) is a policyholder of such coverage for such

months;

“(B) cannot demonstrate (through presentation of

certifications described in section 2704(e) or in such

other manner as may be specified in regulations, such

as a return or statement made under section 6055(d) or

36C of the Internal Revenue Code of 1986), during the

look-back period that is with respect to such

enforcement period, there was not a period of at least

63 continuous days during which the individual did not

have creditable coverage (as defined in paragraph (1)

of section 2704(c) and credited in accordance with

paragraphs (2) and (3) of such section); and

“(C) in the case of an individual who had been

enrolled under dependent coverage under a group health

plan or health insurance coverage by reason of section

2714 and such dependent coverage of such individual

ceased because of the age of such individual, is not

enrolling during the first open enrollment period

following the date on which such coverage so ceased.

“(2) Look-back period.–The term `look-back period’ means,

with respect to an enforcement period applicable to an

enrollment of an individual for a plan year beginning with plan

year 2019 (or, in the case of an enrollment of an individual

during a special enrollment period, beginning with plan year

2018) in health insurance coverage described in subsection

(a)(1), the 12-month period ending on the date the individual

enrolls in such coverage for such plan year.

“(3) Enforcement period.–The term `enforcement period’

means–

“(A) with respect to enrollments during a special

enrollment period for plan year 2018, the period

beginning with the first month that is during such plan

year and that begins subsequent to such date of

enrollment, and ending with the last month of such plan

year; and

“(B) with respect to enrollments for plan year

2019 or a subsequent plan year, the 12-month period

beginning on the first day of the respective plan

year.”.

SEC. 134. INCREASING COVERAGE OPTIONS.

Section 1302 of the Patient Protection and Affordable Care Act (42

U.S.C. 18022) is amended–

(1) in subsection (a)(3), by inserting “and with respect

to a plan year before plan year 2020” after “subsection

(e)”; and

(2) in subsection (d), by adding at the end the following:

“(5) Sunset.–The provisions of this subsection shall not

apply after December 31, 2019, and after such date any

reference to this subsection or level of coverage or plan

described in this subsection and any requirement under law

applying such a level of coverage or plan shall have no force

or effect (and such a requirement shall be applied as if this

section had been repealed).”.

SEC. 135. CHANGE IN PERMISSIBLE AGE VARIATION IN HEALTH INSURANCE

PREMIUM RATES.

Section 2701(a)(1)(A)(iii) of the Public Health Service Act (42

U.S.C. 300gg(a)(1)(A)(iii)), as inserted by section 1201(4) of the

Patient Protection and Affordable Care Act, is amended by inserting

after “(consistent with section 2707(c))” the following: “or, for

plan years beginning on or after January 1, 2018, as the Secretary may

implement through interim final regulation, 5 to 1 for adults

(consistent with section 2707(c)) or such other ratio for adults

(consistent with section 2707(c)) as the State involved may provide”.

TITLE II–COMMITTEE ON WAYS AND MEANS

Subtitle A–Repeal and Replace of Health-Related Tax Policy

SEC. 201. RECAPTURE EXCESS ADVANCE PAYMENTS OF PREMIUM TAX CREDITS.

Subparagraph (B) of section 36B(f)(2) of the Internal Revenue Code

of 1986 is amended by adding at the end the following new clause:

“(iii) Nonapplicability of limitation.–

This subparagraph shall not apply to taxable

years beginning after December 31, 2017, and

before January 1, 2020.”.

SEC. 202. ADDITIONAL MODIFICATIONS TO PREMIUM TAX CREDIT.

(a) Modification of Definition of Qualified Health Plan.–

(1) In general.–Section 36B(c)(3)(A) of the Internal

Revenue Code of 1986 is amended–

(A) by inserting “(determined without regard to