Philadelphia, PA…Nominal credit card balances moved up in the fourth quarter of 2023, establishing a new series high. Card utilization also rose, as is typical at year-end, and consumers with stretched credit lines drew further on those lines. Credit limits increased for more consumers than in the third quarter, especially for those with already-high credit limits.

Fourth quarter 2023 featured the worst card performance in the series. All stages of account-based delinquency reached series highs. Only the 90+ balance-based rate was under its series high, set over a decade ago. As credit performance deteriorated, the median origination credit limit decreased for a second consecutive quarter.

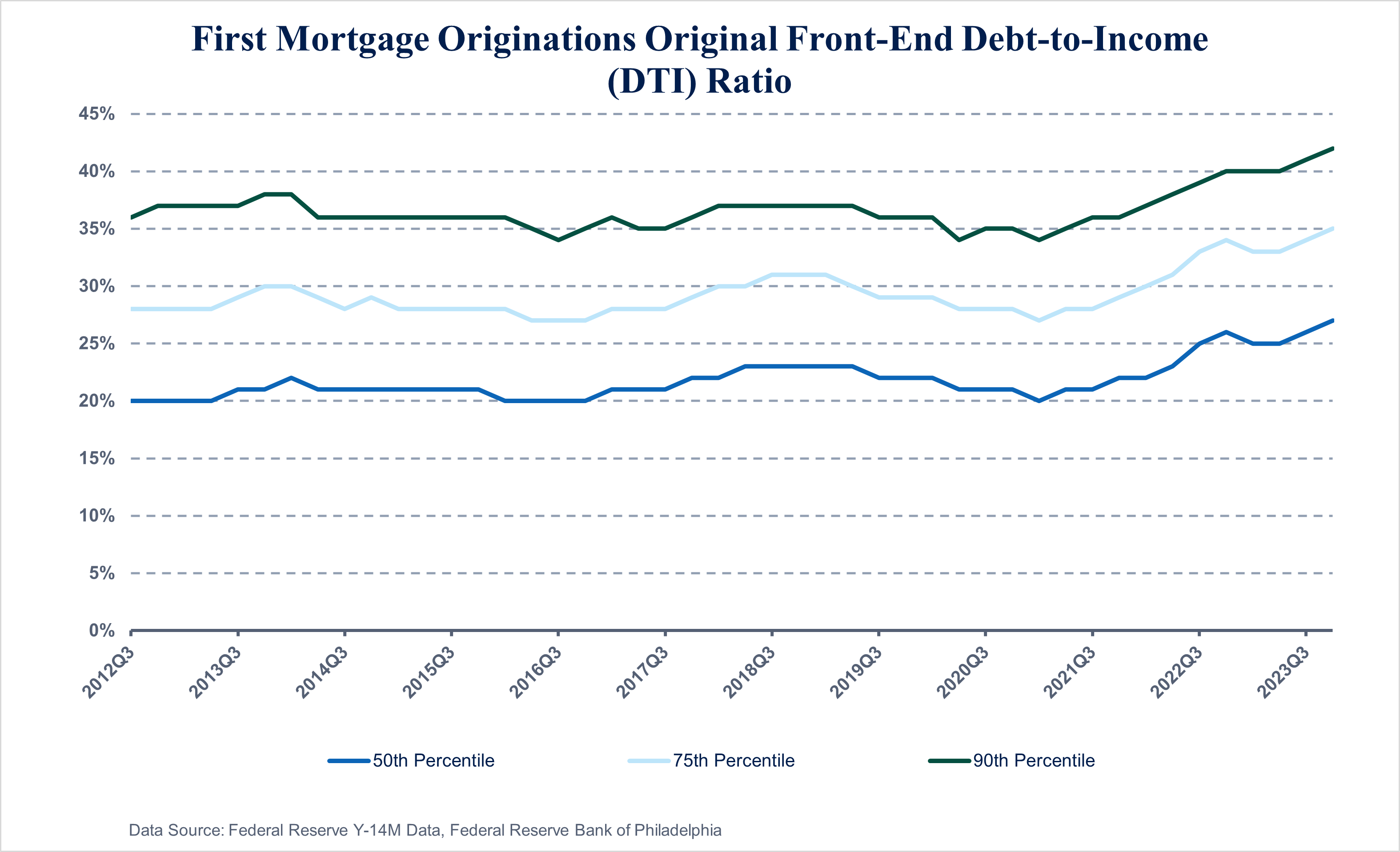

Mortgage originations were the lowest in the series. Originated mortgages hint at a possible change in the risk approach of firms. While credit scores remain steady, median original front-end debt-to-income and loan-to-value are elevated compared with fourth quarter 2021 levels. There was a slight quarter-over-quarter increase in the 30+ days past due rate, but delinquencies are near series lows and well below pre-pandemic levels.

Credit Card Real Balances and Utilization Approaching Pre-Pandemic Figures

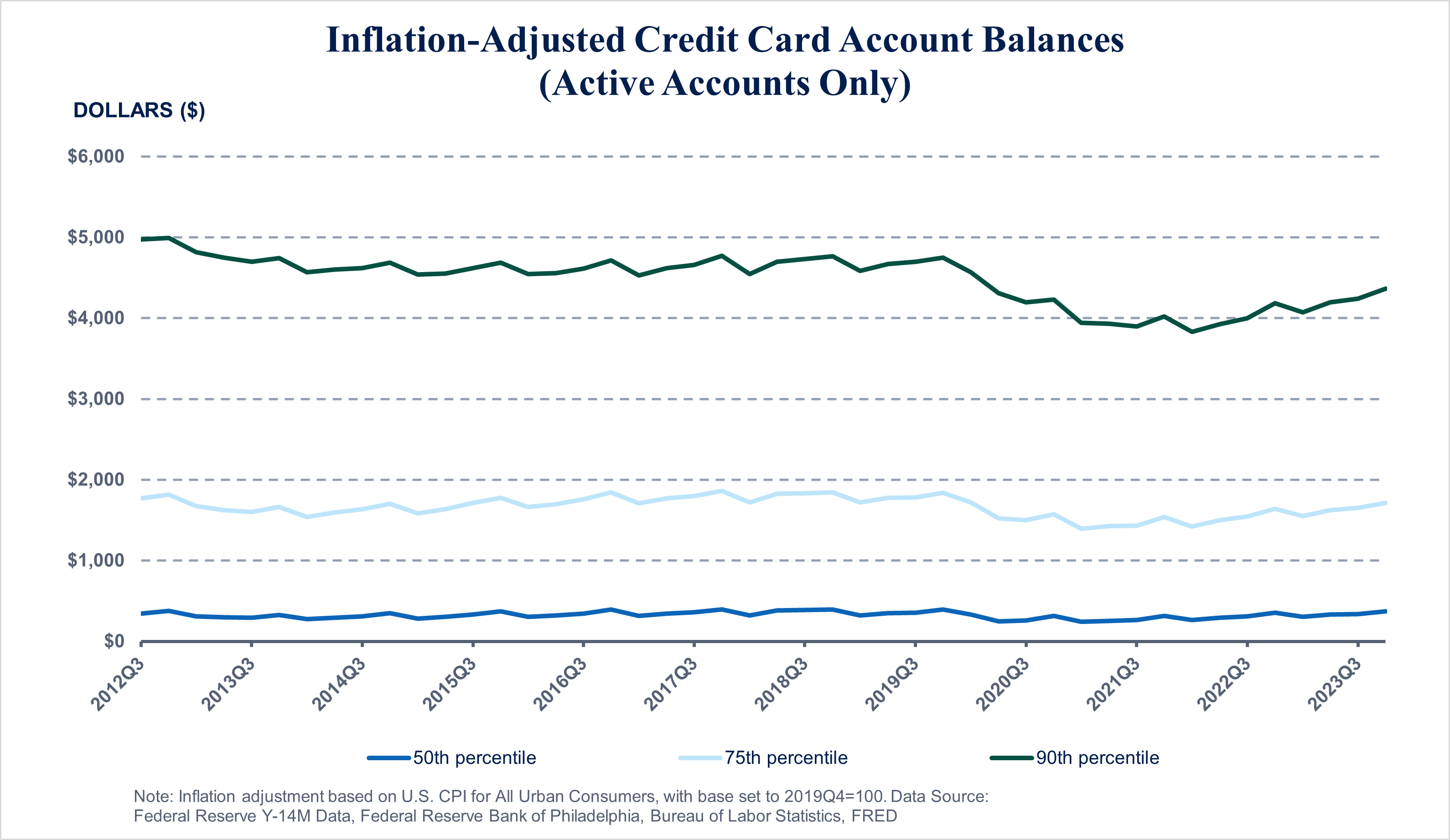

Nominal credit card account balances, which surpassed series highs for the 50th, 75th, and 90th percentiles in the third quarter of 2023, continued to grow in the fourth quarter of 2023. Nominal account balances, however, have increased in the fourth quarter every year in the data because of seasonal factors. When adjusted using the U.S. consumer price index, real account balances remained below the percentile levels reported in the fourth quarter of 2019. Real account balances are quickly approaching pre-pandemic heights, though, with the median real account balance increasing 5.4 percent year over year. Correspondingly, the 50th and 75th percentiles of card utilization rose 35 basis points and 375 basis points year over year and were 31 and 57 basis points shy of where they were at the end of 2019, respectively. The 90th percentile utilization rate is at a series high.

Credit Card Performance Worsened to Historical Levels

Credit card performance further deteriorated at the end of 2023, with firms recording the worst 30+, 60+, and 90+ account-based days past due levels in the reporting series. Notably, card performance usually declines in the fourth quarter. Stress among cardholders was further underscored in payment behavior, as the share of accounts making minimum payments rose 34 basis points to a series high from last quarter’s reading. The share of accounts making full balance payments did tick up 8 basis points in the fourth quarter, but the 3.1 percent increase in revolving balances implies higher card balances among a smaller group of revolvers. Median origination credit scores jumped 2 points, supporting data from the Senior Loan Officer Opinion Survey that suggest that credit card lending standards at most large banks tightened somewhat or remained unchanged in the fourth quarter of 2023. However, current credit scores at the 10th and 25th percentiles of cardholders decreased to their lowest levels since the first quarter of 2020, indicating further performance deterioration could be on the horizon.

New Mortgages Exhibit Riskier Characteristics as Affordability Issues Persist

Originations declined to a series low in the fourth quarter of 2023 as market headwinds continued to stifle overall mortgage demand. Year-end data highlighted shifts in large bank underwriting practices, largely related to rising housing costs. Origination credit scores remain at or near levels observed in the fourth quarter of 2021. However, the median front-end debt-to-income (DTI) ratio rose to a series high and sits 500 basis points above its fourth quarter 2021 level. Median origination loan size and loan-to-value (LTV) have increased 9.3 percent and 900 basis points, respectively, over the same time period. Combined, the increases underscore continued affordability issues as housing costs consume a larger share of borrowers’ budgets. This indication coincides with the Atlanta Fed’s report that home affordability has drastically worsened since the end of 2021.

- Disclaimer: The views expressed in this report are solely those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.