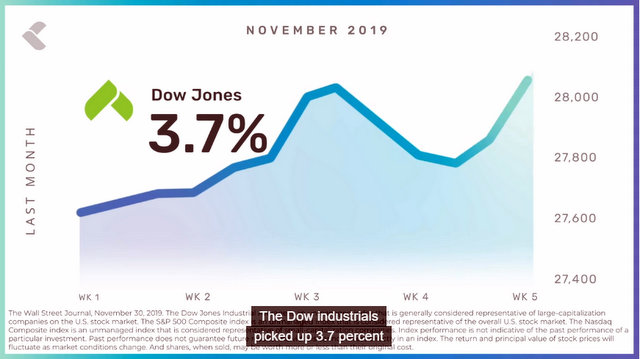

Valley Springs, CA…Stocks notched solid gains in November, thanks to solid economic data, improving trade sentiment, and upside earnings surprises. The Dow Jones Industrial Average picked up 3.72 percent, while the Standard & Poor’s 500 Index gained 3.40 percent. The NASDAQ Composite led, jumping 4.50 percent. It was the best month since June for the three indices.1

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

U.S. Markets |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Stocks notched solid gains in November, thanks to solid economic data, improving trade sentiment, and upside earnings surprises.

The Dow Jones Industrial Average picked up 3.72 percent, while the Standard & Poor’s 500 Index gained 3.40 percent. The NASDAQ Composite led, jumping 4.50 percent. It was the best month since June for the three indices.1

October’s momentum continued into the new month as both the S&P 500 and NASDAQ Composite set record highs on the first day of November, after a better-than-expected employment report. Influence of Trade TalksStock prices continued their march higher on the strength of growing trade optimism and solid corporate earnings. But stocks turned lower in the wake of comments by President Trump that made it clear no trade deal with China had been reached. Investors appeared unfazed by Fed Chair Jerome Powell’s testimony in Congress, which reinforced the Fed’s position that short-term rate cuts would remain on pause until economic data dictate otherwise. It’s All About TradeThe gradual climb higher finally lost momentum, due to fresh concerns sparked by President Trump’s threats to impose new tariffs if a “phase one” trade agreement could not be reached. However, in the final week of trading, stocks pushed higher after some upbeat comments from China about how talks are progressing. Sector ScorecardIndustry sectors were broadly higher in November, with gains in Communication Services (+4.81 percent), Consumer Discretionary (+1.81 percent), Consumer Staples (+1.52 percent), Financials (+5.45 percent), Health Care (+8.45 percent), Industrials (+4.86 percent), Materials (+3.43 percent), and Technology (+6.63 percent). Three sectors, Energy (-0.05 percent), Real Estate (-1.75 percent), and Utilities (-1.64 percent), ended lower.2

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

What Investors May Be Talking About in December |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| With the December shopping season upon us, investors will be searching for clues about the health of the consumer. Retail spending can give an early inkling of fourth-quarter earnings, even before corporations begin reporting their results in January 2020.

Holiday shopping is critical to the economy, accounting for 20 percent of annual retail sales.3 The National Retail Federation expects holiday sales to rise by 3.8 percent to 4.2 percent, but due to a quirk of the calendar this year, retailers may be challenged to meet those expectations.4 Fewer Shopping DaysThe holiday shopping season is six days shorter than last year’s, due to the late arrival of Thanksgiving this year. For now, the consumer appears confident. But market watchers are expected to keep close eyes on the pace of consumer spending through the end of the year. |

|||||||||||||||||||||||||||||||||||||||||||||||||||

World Markets |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Overseas markets trailed U.S. equity performance, with the MSCI-EAFE Index gaining 1.37 percent in November.5

European stocks were generally higher on an improving trade outlook, with major markets posting positive returns. France gained 3.06 percent, Germany rose 2.87 percent, and the United Kingdom picked up 1.53 percent.6 Pacific-Rim stocks were mixed. Australia tacked on 2.74 percent, but Hong Kong lost 2.08 percent.7

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

Indicators |

|||||||||||||||||||||||||||||||||||||||||||||||||||

Gross Domestic ProductU.S. economic growth in the fourth quarter was revised higher, from 1.9 percent to 2.1 percent, owing to upward revisions in inventory and business investment.8 EmploymentPayrolls rose by 128,000 in October, an upside surprise from consensus estimates. The unemployment rate ticked higher to 3.6 percent, a rise that was attributed to more Americans looking for work.9 Retail SalesRetail sales rose 0.3 percent, a relief from the previous month’s decline.10 Industrial ProductionIndustrial output fell for the third time in the last four months, declining 0.8 percent.11 HousingHousing starts increased 3.8 percent in October, while permits for future construction reached the highest level in more than 12 years.12 Existing home sales rose 1.9 percent, exceeding consensus forecasts and reversing the previous month’s decline.13 New home sales unexpectedly fell 0.7 percent, though they were higher by 31.6 percent over October 2018.14 Consumer Price IndexConsumer prices jumped 0.4 percent in October, with higher energy prices accounting for the bulk of the increase. Core inflation, which excludes the more volatile food and energy sectors, rose 0.2 percent.15 Durable Goods OrdersOrders of goods designed to last three years or more moved higher by 0.6 percent, a rebound from their September decline.16 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

The Fed |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Minutes of the last Federal Open Market Committee meeting showed a more unified Fed. More members agreed that in the wake of its third cut in short-term interest rates, it was time to pause and assess future economic data to determine the path of monetary policy.

The members also agreed that weak manufacturing and business investment posed a credible risk to the health of the U.S. consumer.17 By the Numbers |

|||||||||||||||||||||||||||||||||||||||||||||||||||

Season’s Greetings

112.5 million18

People who are expected to travel during the holiday

102.1 million18

Travelers by car

6.7 million18

Travelers by air

590,00021

Number of seasonal holiday workers retailers are expected to hire

$32 billion19

Amount Americans are expected to spend on holiday shopping

$205 billion20

Gross Domestic Product of New Zealand

$68819

Total amount the average shopper is expected to spend on gifts

4 million pounds19

Weight of trash generated from gift wrapping during the holiday

70%22

Percent of people expected to bake or buy desserts this holiday

Pumpkin22

The Midwest’s favorite holiday flavor

Pecan22

The South’s favorite holiday flavor

Pumpkin Pie23

America’s favorite holiday dessert

Eggnog23

America’s second-favorite holiday dessert

| The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite, LLC, is not affiliated with the named representative, broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Investing involves risks, and investment decisions should be based on your own goals, time horizon and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The forecasts or forward-looking statements are based on assumptions, may not materialize and are subject to revision without notice. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial advisor for additional information. Copyright 2019 FMG Suite. |

1. The Wall Street Journal, November 30, 2019

2. Factset Research, November 30, 2019

3. SmallBusiness.com, October 7, 2019

4. SmallBusiness.com, October 7, 2019

5. MSCI.com, November 30, 2019

6. MSCI.com, November 30, 2019

7. MSCI.com, November 30, 2019

8. The Wall Street Journal, November 28, 2019

9. The Wall Street Journal, November 1, 2019

10. The Wall Street Journal, November 15, 2019

11. MarketWatch.com, November 15, 2019

12. CNBC.com, November 19, 2019

13. The Wall Street Journal, November 21. 2019

14. CNBC.com, November 26, 2019

15. The Wall Street Journal, November 13, 2019

16. CNBC.com, November 27, 2019

17. The Wall Street Journal, November 20, 2019

18. TravelAgentCentral.com, 2019

19. CloudWays.com, October 15, 2019

20. The World Bank, 2019

21. The National Retail Federation, 2019

22. DawnFoods.com, 2019

23. Offers.com, November 18, 2019

Pingback: Monthly Market Insights for December 2019 from BluePrint Investments & Tax Planning – The Pine Tree